OTC & Treasury

Tighter Spreads,

Minimal Market Impact.

17 bps

15s

50+

Focus

We bridge the gap between complexity and opportunity, helping corporations, private wealth, and institutions navigate the financial landscape with clarity, precision, and confidence.

By leveraging deep liquidity across all assets and markets, we ensure seamless execution with reduced slippage and discreet operations to protect your positions. Our bespoke treasury strategies optimise your capital, mitigate risks, and provide liquidity tailored to your operational and strategic goals.

- Deep & Instant Liquidity Access

- Discreet Trade Execution

- Tighter Spreads

- Minimal Market & Pricing Impact

What is OTC Trading, and How Does It Work?

OTC (Over-The-Counter) trading refers to the process of trading financial assets directly between two parties, outside of traditional exchanges. It is typically used for large, bespoke, or illiquid transactions that require privacy, flexibility, and tailored execution.

At our firm, we operate as a non-custodial, principal-to-principal OTC trading desk. This means that trades are conducted directly between us and our clients, without the involvement of third-party custodians. As a principal in the trade, we use our own balance sheet to provide liquidity and execute transactions efficiently, ensuring seamless and secure trading experiences.

Our non-custodial approach ensures that clients retain full control over their assets throughout the process, while our principal-to-principal model allows us to deliver competitive pricing, minimize counterparty risks, and maintain discretion in every transaction.

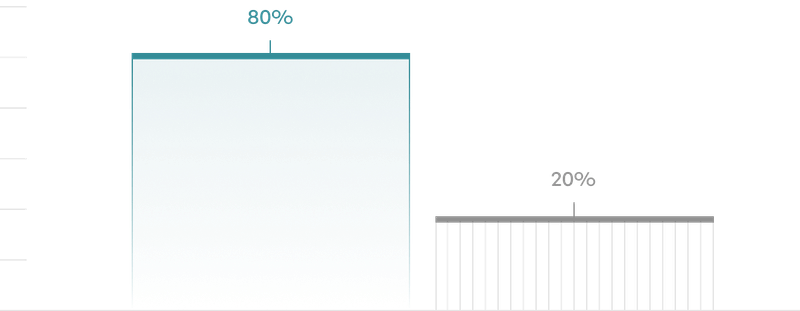

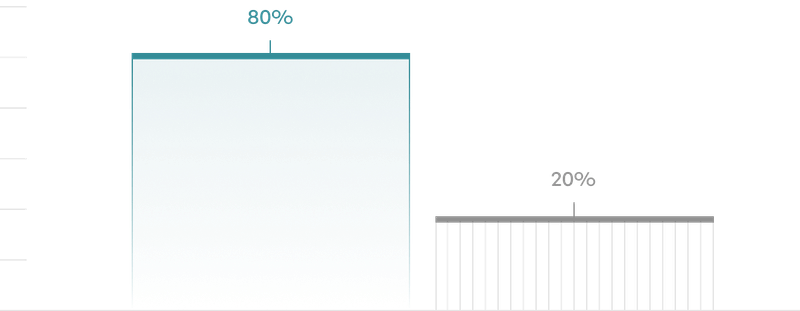

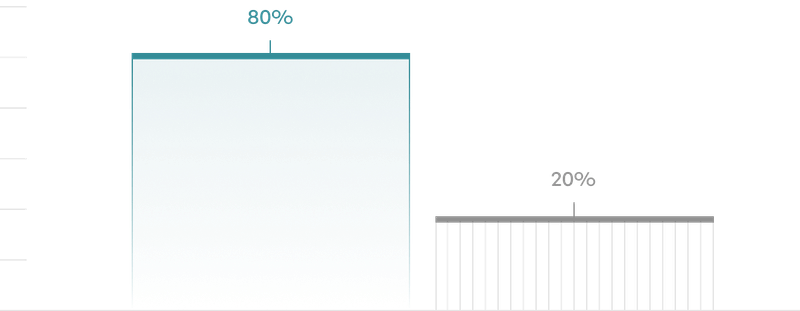

How does trading through an OTC provider differ from trading on an exchange?

OTC trading is designed for large or complex transactions, offering customized pricing, access to deep liquidity, and enhanced privacy. By sourcing liquidity privately from multiple counterparties, OTC providers reduce slippage, ensure stable pricing for significant trade volumes, and offer flexible settlement terms tailored to the trader’s needs. This makes OTC trading ideal for minimizing market impact and maintaining discretion.

In contrast, exchange trading operates through a public order book, making it highly transparent and efficient for smaller, standardized trades. While this transparency is beneficial, large trades on exchanges can lead to slippage and market impact, as liquidity at the best available price may quickly deplete.

Ultimately, OTC trading excels in flexibility, discretion, and handling large trades, while exchange trading prioritizes speed, accessibility, and a standardized approach, making it ideal for smaller, straightforward transactions

Why is our liquidity so deep?

- 50+ traditional and digital-native liquidity providers

- Access to FX, crypto, on- and off-exchange liquidity

- Efficient aggregation minimises price impact

- Expertise in large, complex trades

- Reliable execution in volatile markets

Do we offer fiat on and off-ramp services?

Yes, we do. We provide specialized fiat on and off-ramp services, including the physical delivery of fiat currencies in over 55 countries. Our solutions are designed specifically for institutions and high-net-worth clients, ensuring every transaction is handled with precision, speed, and discretion. Whether you need to convert fiat into digital assets or liquidate digital assets back into fiat, we guarantee a seamless and secure experience. With strict adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, we deliver a trusted, compliant, and globally integrated infrastructure to bridge the gap between traditional finance and alternative asset ecosystems.

"Spot OTC is all about precision, adaptability, and delivering liquidity on demand—ensuring seamless execution in every trade."

Liquidity Matters

Liquidity is the lifeblood of financial and digital markets, enabling them to function efficiently and effectively. Without sufficient liquidity, markets become fragmented, volatile, and costly to transact in. Market making ensures the smooth operation of trading ecosystems by offering continuous buy and sell quotes, narrowing spreads, and enabling seamless trading without interruptions.

- Always Open for Trading

- Fairer, Tighter Spreads

- Stable, Resilient Markets

238k

1B+

Optimising Liquidity

Liquidity is the lifeblood of trading ecosystems in today's fast-paced financial and digital markets. Market making ensures the smooth operation of these markets by providing continuous buy and sell quotes, reducing spreads, and enabling participants to trade seamlessly without disruptions.

.

Market Stability & Access

Our market-making solutions are designed to address liquidity challenges and unlock the full potential of trading ecosystems. By acting as a dependable counterparty, we optimise liquidity, stabilise markets, and enhance trading efficiency. This creates a more accessible, resilient, and transparent environment for all market participants.

- Optimised Liquidity

- Better Price Discovery

- Stabilised Markets

The Bottom-Line Benefits

Effective market making drives broader growth by fostering confidence, innovation, and participation. With optimised liquidity and stable markets, opportunities expand for traders, institutions, and the entire ecosystem.

- Lower barriers encourage wider market participation.

- Stable markets enable new financial products and technologies.

- Sustainable growth and efficiency attracting long-term trust.

Access liquidity. Bridge markets.